"BullBearFin – Simplifying the Stock Market, One Insight at a Time"

"Welcome to BullBearFin — your hub for stock market knowledge and market trends. We bring you clear explanations, in-depth articles, and data-driven insights to help you understand how markets move and how different strategies work, without offering investment tips."

What is Stock Market

The stock market is where people buy and sell shares — tiny pieces of ownership in companies. It connects businesses that need funds with investors who want to grow their money. When you buy a share, you become a shareholder, meaning you own part of that company. If the company does well, your share value may rise. If not, it can drop — that’s why the stock market comes with both opportunities and risks.

Types of Financial Markets Explained

Learn about all types of financial markets – equity, debt, commodity, forex, and derivatives. Understand FII & DII roles, trading opportunities, and investment risks.

Commodities Market: An Overview

The commodities market is where raw materials and primary agricultural products are traded. These markets allow producers, traders, and investors to buy and sell goods like crude oil, gold, silver, natural gas, wheat, coffee, and cotton. Commodities trading plays a vital role in the global economy, helping stabilize prices and manage supply and demand.

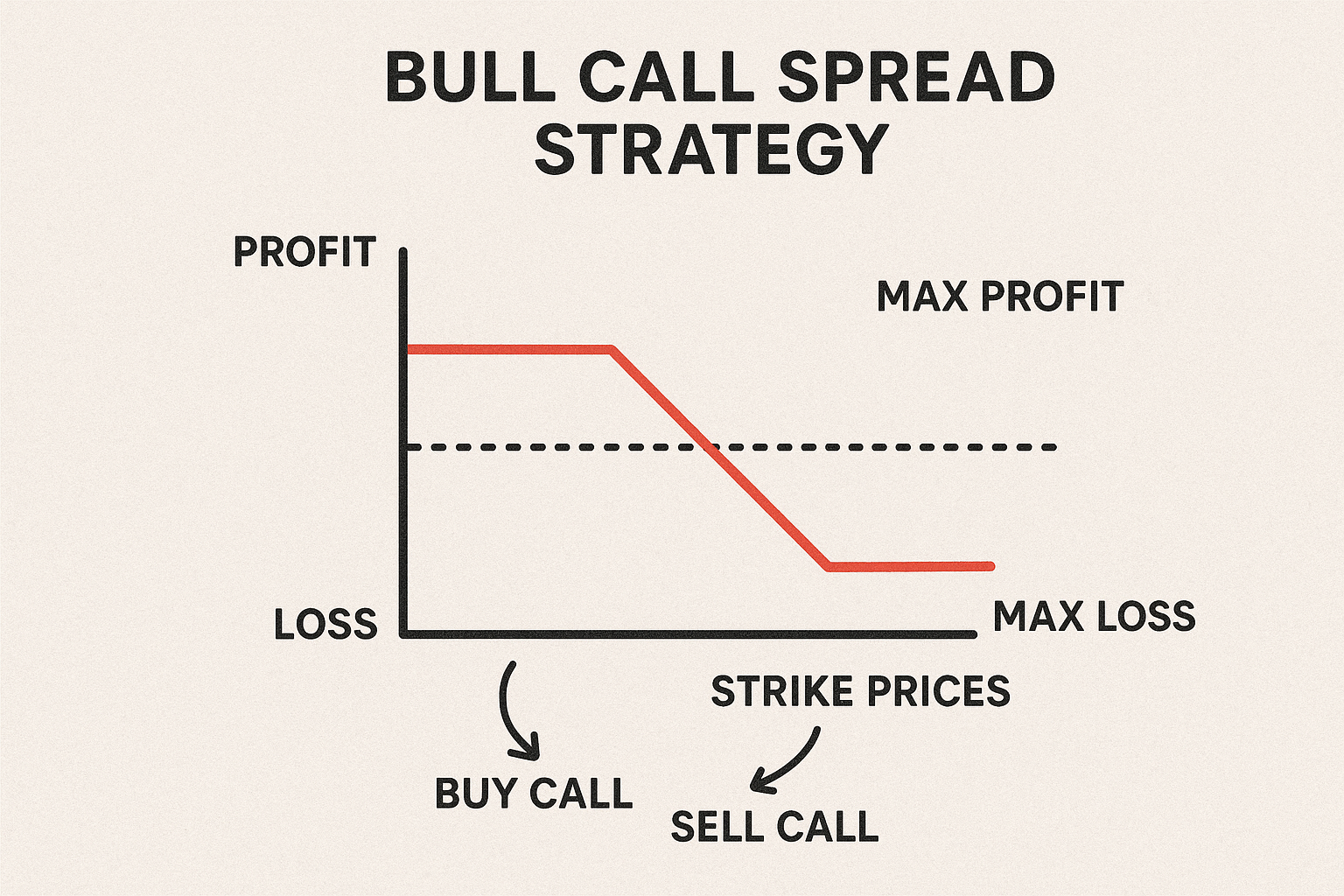

Bull Call Spread Strategy Explained

Options trading provides market participants with a wide range of strategies to express directional views while managing risk. Among these, the Bull Call Spread is a widely used strategy designed for traders who expect a moderate rise in the underlying asset’s price within a specified time horizon.

Top 5 Options Trading Strategies for Beginners

Options trading is one of the most exciting parts of the stock market. While it provides traders with the opportunity to earn high returns, it can also be extremely risky if not understood properly.

What are Futures Contracts? With Examples

The stock market is often seen as a place where people buy and sell shares. But there is a deeper, more powerful part of the market that professional traders, institutions, and hedge funds actively use—this is the Futures & Options (F&O) market.